- Home

- About Us

- Products

- VQueue.Network (VQN)

- VQN Banking

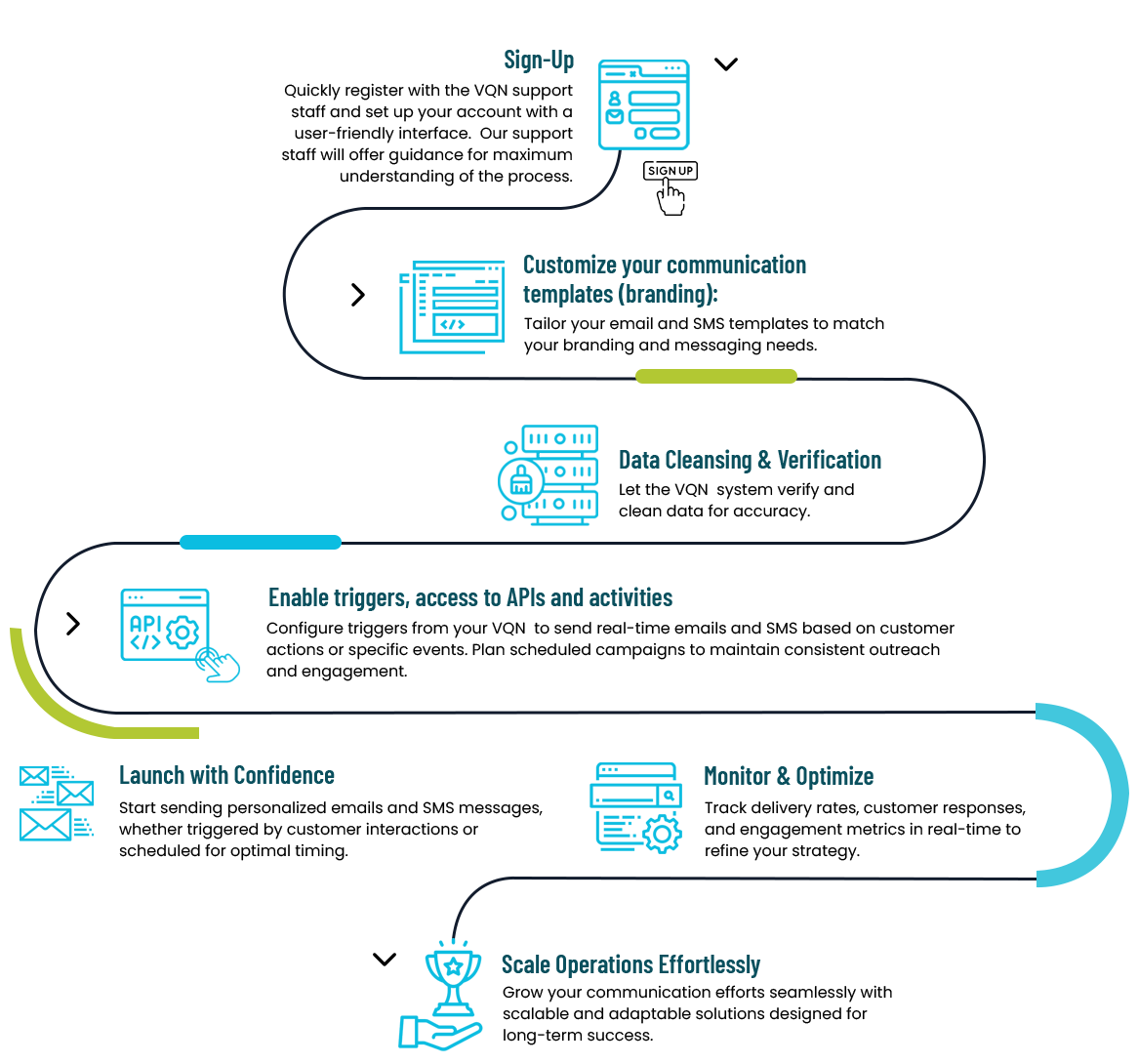

- VQN agency

-

VQueue.Network (VQN)

Streamlined Email & SMS Solutions for Collections & Recovery ProcessesVQN Banking

The enterprise wide Debt Collection Software choice for Financial Institutions.VQN Agency

The enterprise wide Debt Collection Software choice for Financial Institutions.

- Products

- Support

- Partners

- Contact Us